Our new investment idea: Hanesbrands Inc (NYSE: HBI)

5 (374) · $ 19.50 · In stock

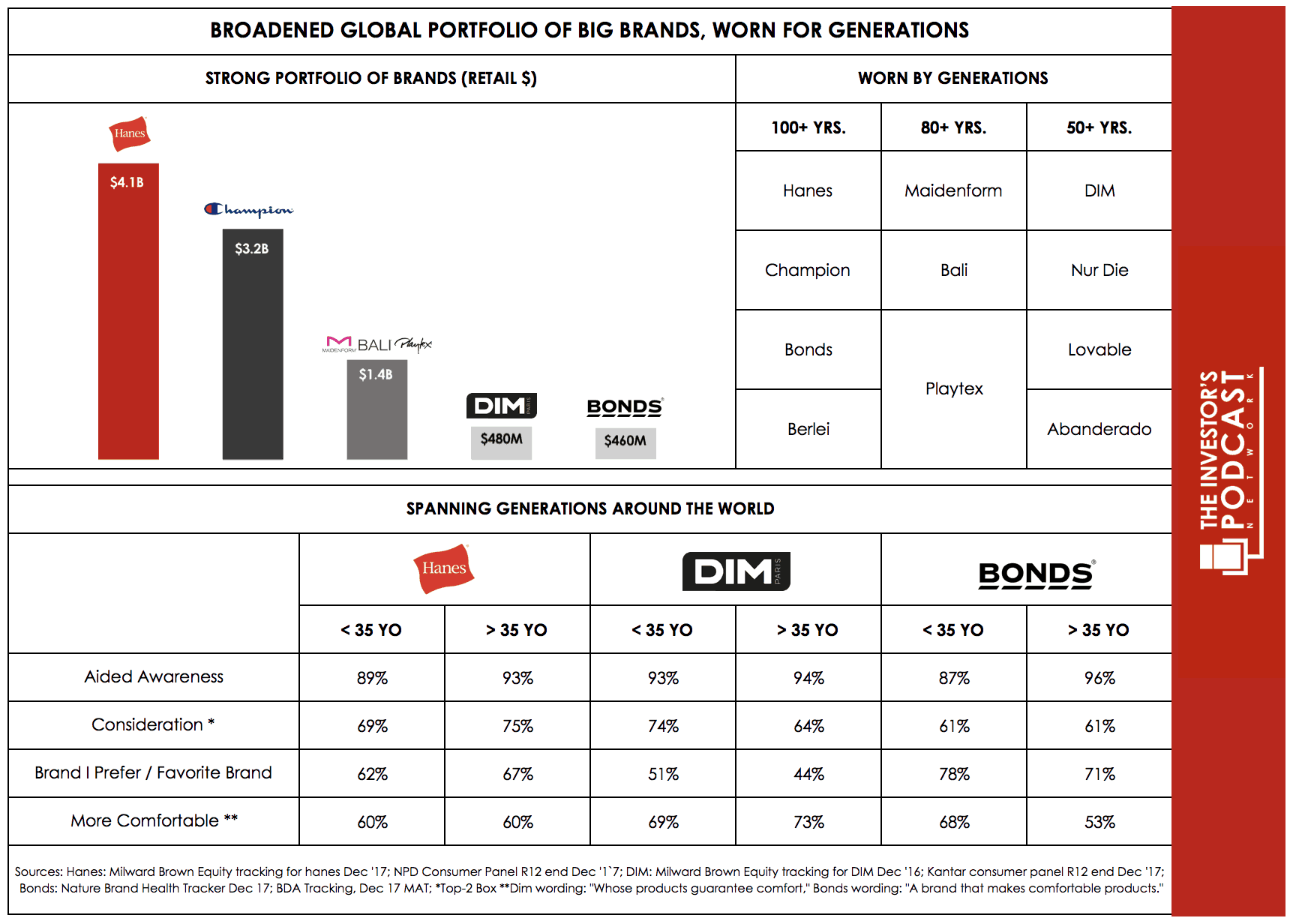

Over the last year, the market has been consistently affected by the consequences of lockdowns, inflation, and financial constraints, which have impacted various industries - particularly the apparel industry. This has resulted in supply chain disruptions and increased production costs, putting pressure on the global apparel market. Because of these challenges, some companies have become potential bargains. In this context, we will explore Hanesbrands Inc. in this write-up.

Why Hanesbrands Stock Was Falling This Week

Hanesbrands Inc.'s (NYSE:HBI) Intrinsic Value Is Potentially 82% Above Its Share Price - Simply Wall St News

Looking at the downfall of Hanesbrand. Very similar to BOBBY. Not just in terms of the chart…but how it happened. Hanes had flat revenue. Expenses went up. And similar to BBBY in

HBI Stock Price Quote

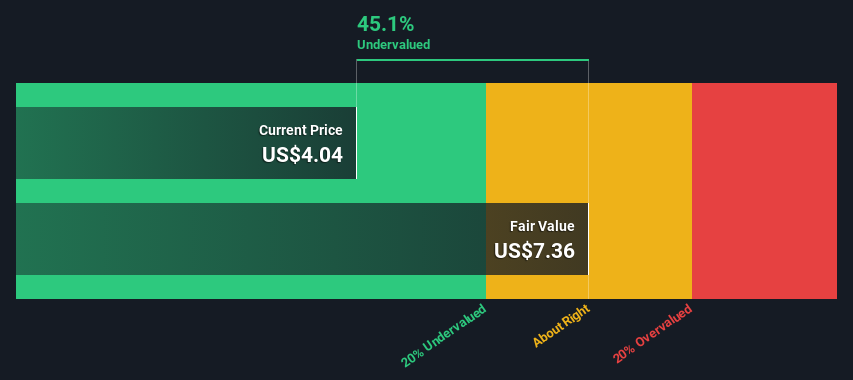

Hanesbrands Inc (HBI) Intrinsic Value Assessment

Our new investment idea: Hanesbrands Inc (NYSE: HBI)

HanesBrands Inc. - HanesBrands Provides Details for Fourth-Quarter 2023 Earnings Announcement and Investor Conference Call

Hanes: $HBI Is Looking Good!

Giles Capital (@GilesCapital) / X

Buy HBI? Yes! The Bull Case for Hanesbrands.

Hanesbrands Q2: Is Reduced Inventory, Market Upheaval Shaping the Future?

Hanesbrands Inc (HBI) Intrinsic Value Assessment