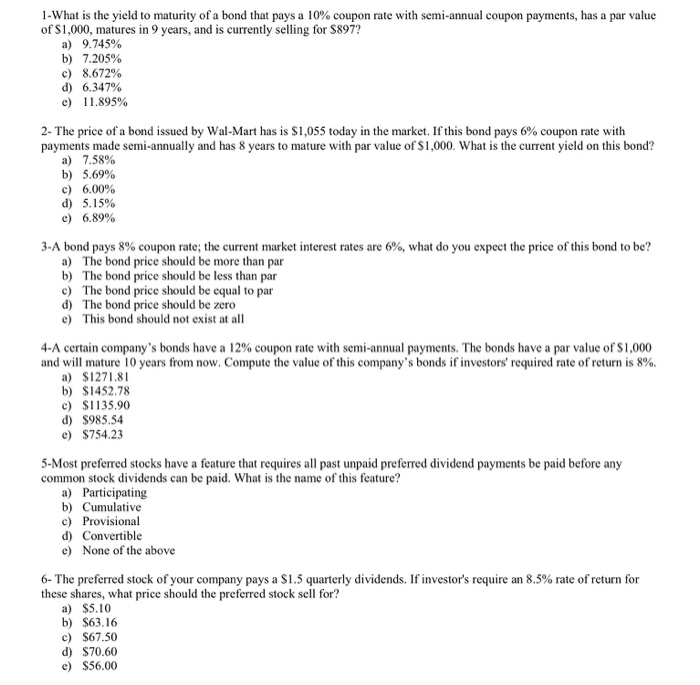

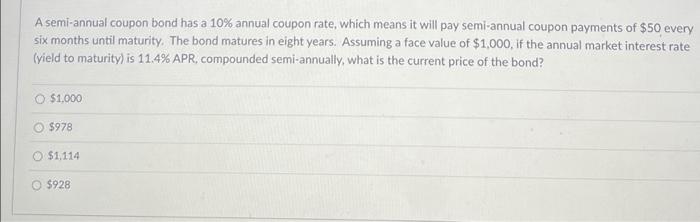

Solved A semi-annual coupon bond has a 10% annual coupon

4.7 (594) · $ 11.99 · In stock

Solved] A 20-year, 8% semiannual coupon bond with a par value of $1000 may

Solved] A 10-year, 12% semiannual coupon bond with a par value of $1,000

Consider a bond paying a coupon rate of 10% per year semiann

Solved] hello may you please help me with these three questions please.

Solved What is the yield to maturity of a bond that pays a

SOLUTION: Bond Valuation practice questions and solutions strathmore university - Studypool

Regal Health Plans issued a ten-year, 12 percent annual coupon bond a few years ago. The bond now sells for

Lecture on bond - ppt download

What is the duration of a two-year bond that pays an annual coupon of 12 percent and has a current yield to maturity of 14 percent? Use $1,000 as the face value. (

7-1 CHAPTER 7 Bonds and Their Valuation Key features of bonds Bond valuation Measuring yield Assessing risk. - ppt download

Answered: Example: Suppose that a bond has a face…

Bond Valuation Problems, PDF, Bonds (Finance)

If the face value of a semi-annual coupon bond is $1,000, the coupon.pdf

Chapter 5 Model, PDF, Bonds (Finance)

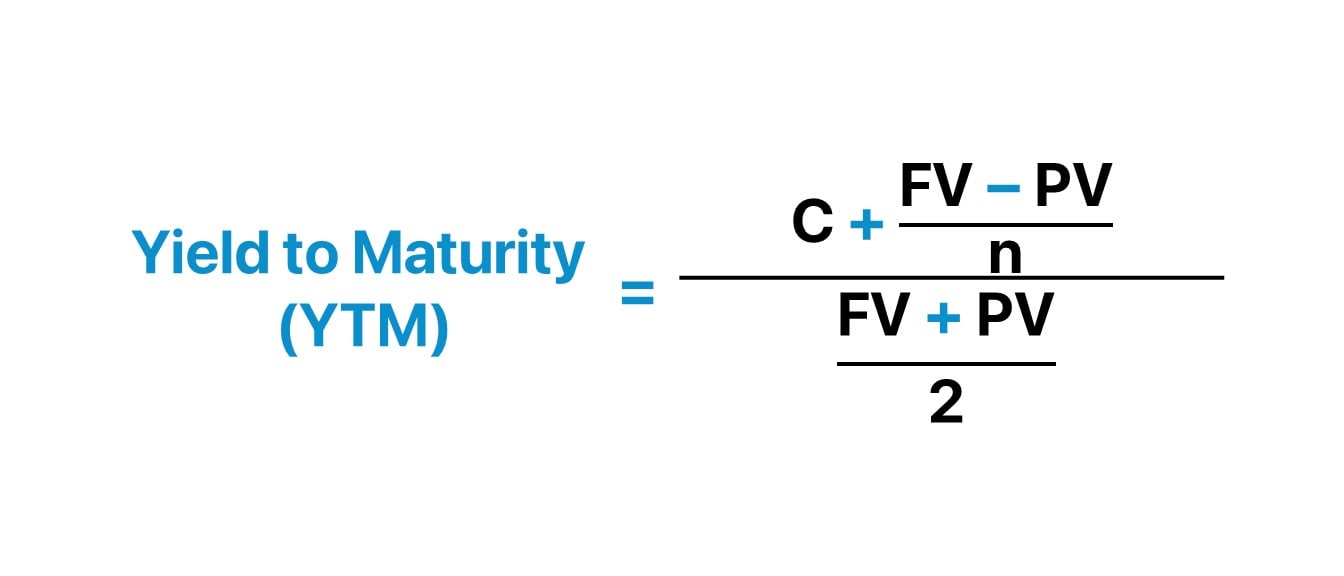

Yield to Maturity (YTM)

-1024x1024.png)