- Home

- andorra non

- Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

5 (156) · $ 15.50 · In stock

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

Taxes in Andorra ▷Types and Fees [2024]

Taxation in Andorra: Requirements and top tips - Delvy

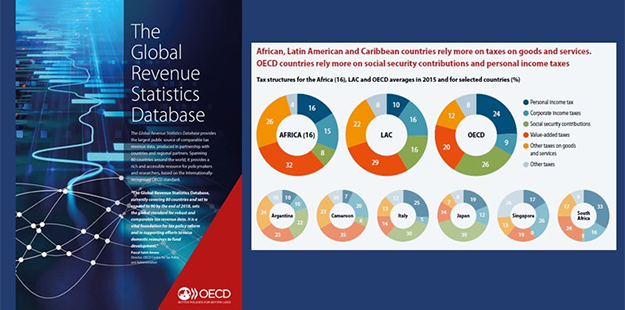

OECD Tax Database - OECD

OECD Tax Database - OECD

How do corporate taxes for small businesses vary around the world? - Vivid Maps

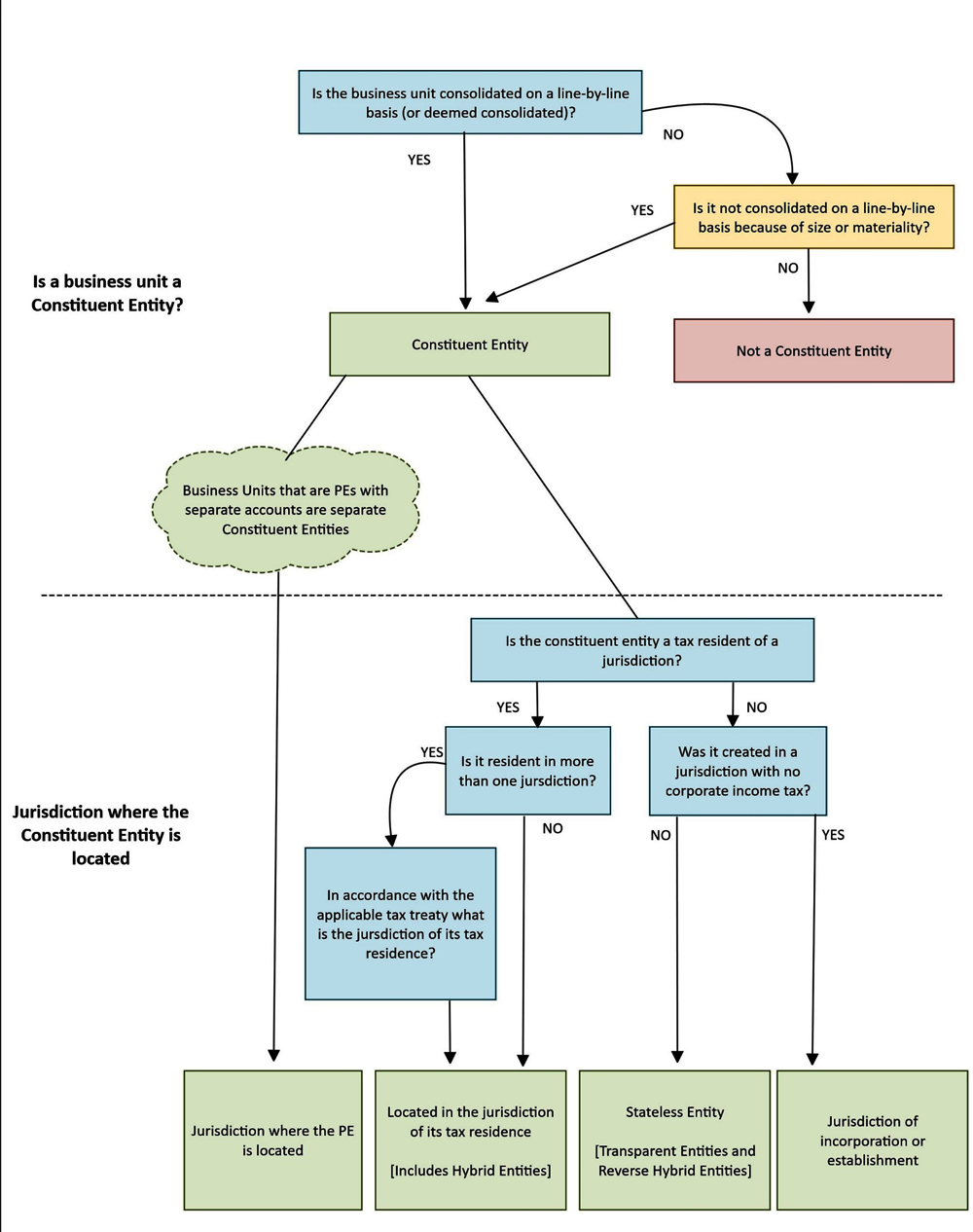

Annex A. Examples, Tax Challenges Arising from Digitalisation – Report on Pillar Two Blueprint : Inclusive Framework on BEPS

Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

List of countries by tax rates - Wikipedia

Discover Andorra's Favorable Tax System: A Guide to Taxes in Andorra

a.storyblok.com/f/176292/1536x864/d9db9258ee/resid

Taxes in Andorra ▷Types and Fees [2024]

a.storyblok.com/f/176292/1536x864/c372a76710/andor

The Andorra Tax System

The Andorra Tax System

.webp)