Section 2(11) Income Tax: Block of Assets - Meaning & Concept

5 (642) · $ 19.50 · In stock

Section 2(11) of Income Tax defines 'Block of Assets' as a 'group of assets' in respect of which the same percentage of depreciation is to be applied

Almost too good to be true: The Section 1202 qualified small business stock gain exclusion, Our Insights

Expecting a Step-Up on Your S Corporation Acquisition? Structure Carefully!, Alvarez & Marsal, Management Consulting

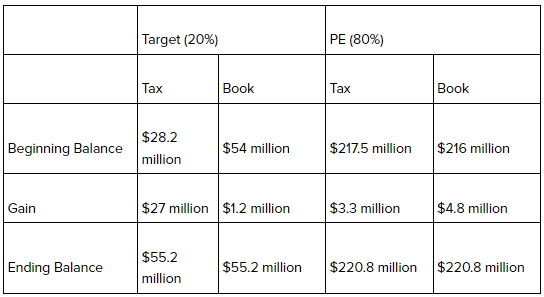

Rolling Over and Section 704(c); What's the Big Deal? — Part 2: The Traditional Method - Lexology

Are There Any Tax Implications Associated With Asset Based Lending - FasterCapital

Publication 946 (2023), How To Depreciate Property

Unabsorbed Depreciation Set Off & Carry Forward - Section 32(2)

How selling equities before March 31 can help you save income tax - The Economic Times

What to know about Form 4562 Depreciation and Amortization

What does box 11 “nonqualified plans” on your W-2 form mean? - Quora

Form 4562: A Simple Guide to the IRS Depreciation Form

Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Understanding the Balance Sheet Statement (Part 2) – Varsity by Zerodha

%20sample%20P%201_.gif)

RVC Standard Laser Format